Washington – US President Donald Trump has recently intensified the ongoing trade tensions with China by threatening to impose a steep 155% tariff on Chinese imports starting November 1, 2025, unless a fair trade deal is reached between the two countries. This unprecedented tariff rate marks a significant escalation from the already high existing tariffs of around 55%, which China has been paying to the US for years.

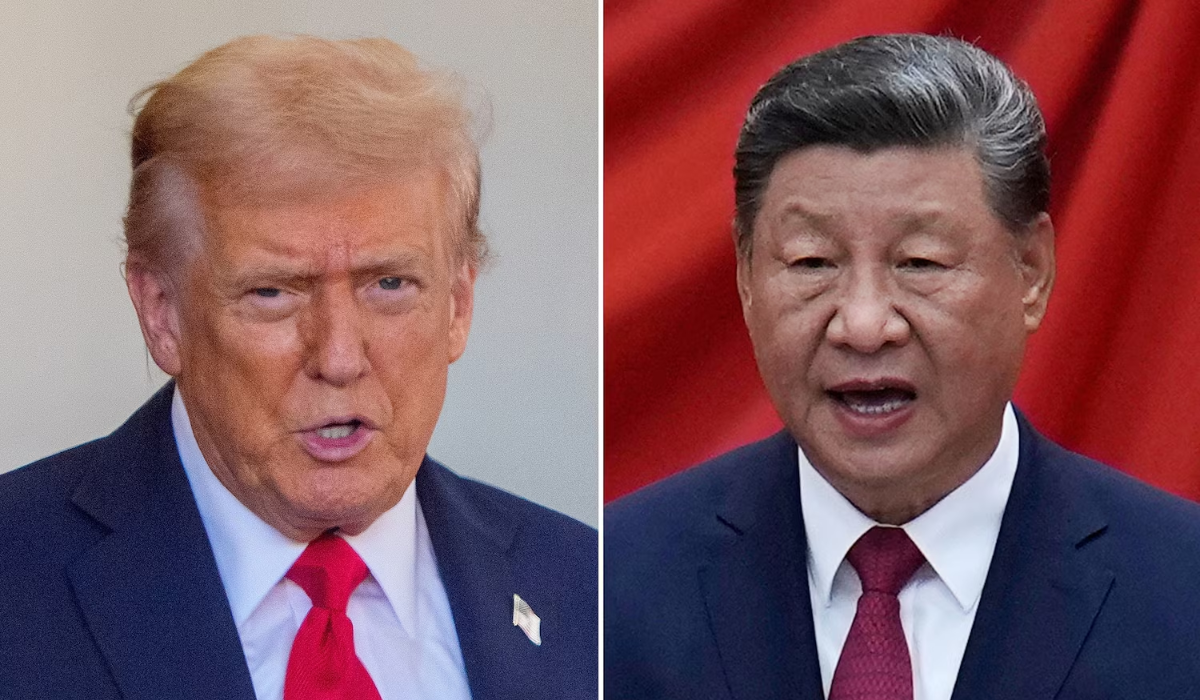

Trump’s 155% Tariff threat comes at a crucial time as both nations prepare for high-level trade talks, including an upcoming meeting with Chinese President Xi Jinping. US President Donald Trump has recently intensified the ongoing trade tensions with China by threatening to impose a steep 155% tariff on Chinese imports starting November 1, 2025, unless a fair trade deal is reached between the two countries. This unprecedented tariff rate marks a significant escalation from the already high existing tariffs of around 55%, which China has been paying to the US for years.

The President articulated that China has been paying substantial amounts in tariffs but warned that failure to come to an agreement could lead to a drastic increase in tariffs, causing significant economic impact. Trump emphasized that the tariff levy can be reduced if China agrees to meet US demands, which include restarting purchases of US soybeans and addressing the fentanyl crisis by controlling its exports to the US. He conveyed a message of not wanting to harm China but insisted that reciprocal actions are necessary to end what he described as a one-sided trade relationship.

In addition to the tariff threats, Trump suggested that the US might impose export restrictions on aircraft parts, specifically targeting China’s aviation industry, highlighting the power the US holds over China’s ability to operate over 400 aircraft reliant on American parts. This move comes in response to China’s tightening of export controls on rare earth materials—critical components for technology products like smartphones, electric vehicles, and military equipment. The US has countered by collaborating with allies like Australia and Japan to diversify supply chains for these critical minerals, reducing reliance on China.

Trump’s trade rhetoric echoes his earlier stances during his previous administration but with heightened tariffs and new leverage points, signaling a more aggressive negotiation strategy. Despite the stern tone, Trump remains optimistic about reaching a “fantastic deal” that benefits both countries and the global economy.

He highlighted his good relationship with President Xi and indicated that negotiations would continue soon, with expectations of a strong trade agreement by the forthcoming Asia-Pacific Economic Cooperation (APEC) summit and bilateral meetings.

The implications of such high tariffs and trade restrictions are broad-ranging. They could disrupt global supply chains, increase consumer prices in the US, and intensify economic tensions worldwide. Key affected sectors include the aviation industry, technology reliant on rare earths, and agriculture, particularly soybean farmers who have faced Chinese boycotts. Moreover, financial markets are closely watching these developments, as ongoing trade disputes often lead to volatility.

Trump’s approach also includes a strategic blend of pressure and optimism. By imposing hard deadlines and steep tariffs while signaling openness to negotiations, he aims to compel China to make concessions that address US concerns, including intellectual property rights, trade imbalances, and drug trafficking. The President’s signing of a critical minerals agreement with Australia during the same period further underlines a long-term strategy to counter China’s dominance in essential raw materials.

Looking ahead, attention will focus on China’s response, the progress of inter-governmental talks, and the enforcement of new tariffs or trade restrictions. How these negotiations unfold will significantly shape the economic relationship between the world’s two largest economies, with considerable consequences for international trade, global markets, and geopolitical dynamics.